Frequently Asked Questions About ACH Payments

ACH payments are a great solution for any business that invoices customers. In contrast to credit card payments, ACH transactions transmit money using your bank account and routing number. Whether a direct deposit or an ACH withdrawal from your customer’s account, these electronic transfers are reliable and safe. ACH also reduces customer churn and eliminates the costs of chasing late payments.

What is ACH?

ACH payments are bank-to-bank electronic transfers processed by the Automated Clearing House Network. Generally, these transactions involve money going into an account (direct deposit), such as payroll, benefits and tax refund deposits, or out of an account (direct debits, such as bill payments or online shopping purchases).

ACH transactions can also include one-time payments made by credit card. They are popular for small businesses such as contractors, massage therapists, coaches, and consultants who invoice for their work. The number of ACH debit and credit transactions is growing every year.

In 2020 alone, the ACH network processed more than $61.9 trillion in payments—with more than $5 trillion representing business-to-business (B2B) transactions.

Typically, ACH payments are less expensive for businesses than credit card transactions, although the cost will depend on your bank and payment processor. You can minimize processing costs by limiting the monthly transactions you initiate. But what is an ACH payroll? Using ACH for your payroll effectively reduces the cost of paying employees with checks and avoids some associated risks like check fraud or lost/stolen checks.

The ACH system allows you to automatically transfer funds directly into your employee’s personal bank accounts on payday—without the need for paper checks and postage. It’s a smart choice for companies that value efficiency and control over cash flow.

How do ACH payments work?

ACH payments are electronic transactions that transfer funds between bank accounts. You can use ACH payments to pay your employees directly into their personal bank accounts at designated paycheck dates. Business owners can also use ACH to automate recurring payments for services like memberships, subscriptions, and billing cycles.

It improves efficiency and eliminates the need for paper checks, which are vulnerable to theft or loss. Whether accepting payments or making them, you need to know a few key pieces of information before processing an ACH transaction.

The first step is acquiring authorization from your customer or client. It can be done digitally via an online form or with a traditional signature on a paper document. Then, you must provide the customer’s banking information (routing and account number) to your payment processor.

Your payment processor then submits the details to the ACH network and a transaction request. The ACH network processes payments four times daily, but it can take up to three days for the money to appear in the recipient’s bank account. That timeline can be shortened to two days if you opt for Same Day ACH. Each ACH transaction includes a unique entry that contains the following information:

How can I use ACH payments in my payroll?

As a small business owner, you can use ACH payments to automate your payroll process and eliminate the need for paper checks. Instead, money is transferred electronically to your employees’ personal bank accounts, eliminating the need for human error and reducing operational risks like lost or stolen checks.

With ACH direct deposit, you or your payroll service provider sends instructions to the ACH network, which then withdraws funds from your business account and deposits them into your employee’s accounts. Depending on your bank, the process may take several days to complete. You can often speed up ACH processing time by paying an additional fee.

You can also use ACH to make one-time or recurring payments to vendors, clients and customers. Many of these transactions can be more cost-efficient than credit card payments, and ACH is especially useful for high-volume or recurring payment types. You’ll need the payee’s bank account and routing number, which you can get from them or their financial institution.

You may also require the ACH account origination code, usually indicated by a specific letter in the transaction data. You can also add an optional reference ID, up to eight characters long. It can be used to identify the file within the ACH system, and it’s typically added in the Reference ID field of the ACH file.

What are the benefits of ACH payments?

ACH payments offer many benefits for both businesses and customers. For businesses, they help to automate and streamline accounting processes by eliminating the need to manually synchronize paper invoices and credit card receipts with bank records.

They also typically cost less than credit card transactions, although each payment processor determines pricing. Employees who have opted in to direct deposit through their employer receive their paychecks via an ACH transaction. It eliminates the need for businesses to issue and mail paper checks, reduces the risk of fraud or misplacement, and speeds up the time it takes for employees to access their funds. ACH payments are generally available by 9:00 am on the day of payday.

ACH payments for vendors and other third parties are also gaining popularity, particularly among small business owners who use online accounting tools. They are more convenient than paper invoices and often provide a more accurate payment record than credit cards. Plus, they are cheaper than paper checks and reduce processing fees, postage, ink, transportation and labor costs.

Lastly, they reduce the chance of human error by automatically debiting accounts for recurring payments. Even though almost everyone is familiar with the benefits of ACH payments from their employers’ direct deposit programs, many business owners are still missing out on the advantages this popular technology offers.

You May Also Like

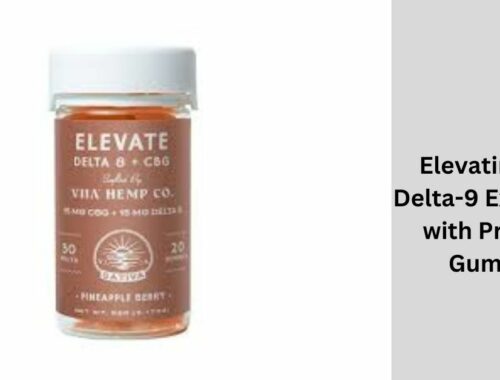

Primo Vibes: Elevating Your Delta-9 Experience with Premium Gummies

February 13, 2024

Unlocking the Potential: Exploring the Characteristics of 10GBASE-T SFP+RJ45 30M

March 13, 2024