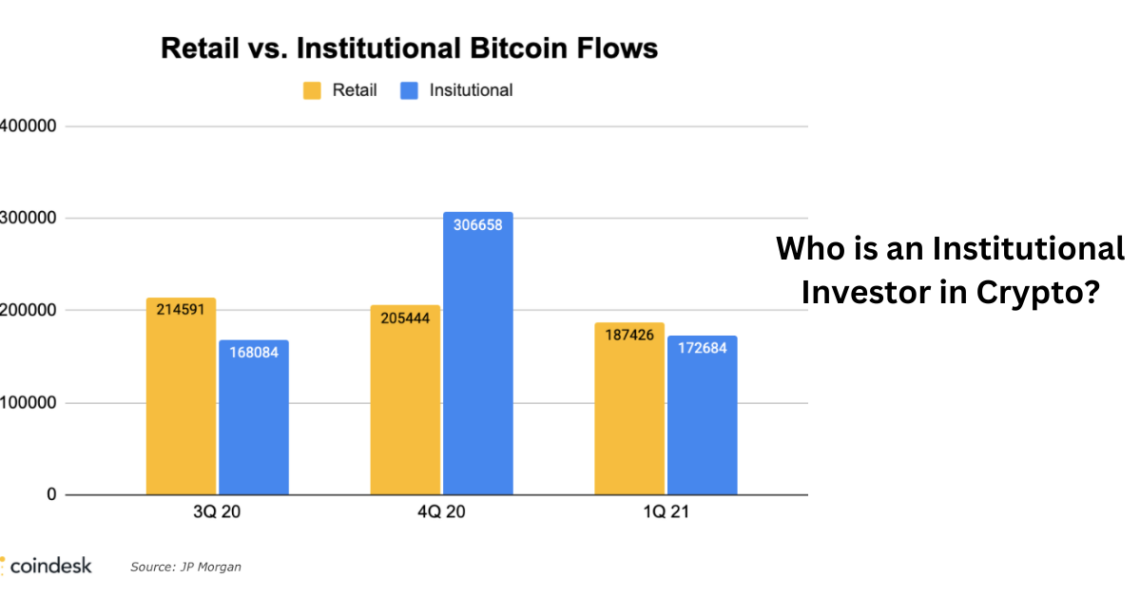

Who is an Institutional Investor in Crypto?

In the early years of cryptocurrencies, traditional companies and financial entities perceived crypto as the cloud that would disappear sooner or later. The idea of institutional investments in digital assets used to sound like ridicule because the crypto space was perceived as a place for crypto fans and enthusiasts only.

However, time has turned things upside down. Today’s reality is that companies are actively tapping into the crypto industry in different ways. Institutional cryptocurrency trading is gaining momentum, and in this article, we will discuss what are institutional investors in crypto and how they enter the market.

Crypto Institutional Investors – Who Are They?

Institutional investors are a diverse range of entities, including:

- hedge funds;

- investment firms;

- corporations;

- financial entities, banks;

- technological companies;

- family firms.

Unlike individual retail investors, institutions often operate with substantial capital, seeking exposure to the crypto market for diversification and high returns. Their entry into the crypto space signifies a growing acceptance of digital assets within mainstream finance and contributes significantly to the maturation and evolution of the cryptocurrency market.

Some Options for Institutional Investments

Here are the ways institutions use crypto:

- Trading – institutional buying and selling of digital assets to make a profit on price volatility. Active participants in trading can also partner with an institutional cryptocurrency platform they use and become liquidity providers (or market makers). Market making platform implies cooperating with a trading platform to maintain its liquidity and gain income.

- Holding. Many companies just hold Bitcoin long-term. Examples are Microstrategy and Tesla.

- Investing in exchange-traded funds (ETFs). ETFs are a type of investment fund that tracks the price of a particular asset or group of assets. There are now several ETFs that track the price of Bitcoin, Ethereum, and other cryptos. It makes it easier for institutions to invest in crypto without having to directly buy and sell assets.

- Participation in the DeFi landscape and earning from yield farming, loans, and insurance.

- Using crypto as a part of the payment system (like PayPal does).

- Integration of digital assets to meet the needs of crypto-oriented clients and provide crypto investment desks (like Goldman Sachs or Morgan Stanley do).

Conclusion

Understanding the prospects of the crypto market, particularly its decentralization and profitability, caused the wave of institutional investors influx. And it appears, there’s enough space for large players, moreover, today they play a crucial role in forming the future crypto landscape.

Institutional investment companies develop new products and services that help them enter the crypto market, hedge against risks, and pay for goods and services. At this rate, we should expect even broader adoption of crypto in the future.

You May Also Like

Navigating the Digital Classroom: A Guide to CSU Blackboard

January 30, 2024

Sargarpgio: Your Gateway to Revolutionary AI Text Role-Playing Adventures

November 6, 2023