QuickBooks – What Is It? An Expert’s Guide

Small businesses are the backbone of the global economy, contributing significantly to job creation and economic growth.

However, managing finances efficiently can be a daunting task for small business owners, often wearing multiple hats to keep their operations running smoothly.

This is where QuickBooks comes into play. QuickBooks, developed by Intuit, is a powerful financial management software that has revolutionized the way small businesses handle their finances.

In this article, we will explore how QuickBooks simplifies financial management for small businesses.

Streamlined Bookkeeping:

One of the key features that make QuickBooks indispensable to small businesses is its ability to streamline bookkeeping. Traditional methods of bookkeeping involve manual data entry, which can be time-consuming and error-prone.

Also Read: WHAT IS LASRS LOGIN

QuickBooks automates this process by connecting to your bank accounts and credit cards, allowing you to import transactions effortlessly. This not only saves time but also reduces the risk of data entry errors.

Efficient Invoicing and Payment Tracking:

Generating invoices and tracking payments can be a hassle for small businesses. QuickBooks offers user-friendly tools for creating professional invoices that can be customized to match your brand.

You can send invoices directly through the software and track when they’ve been viewed and paid. This helps in improving cash flow management and reducing the risk of late or missed payments.

Expense Tracking and Management:

Small business owners need to monitor expenses closely to control costs and maximize profitability. QuickBooks simplifies expense tracking by allowing you to categorize expenses, attach receipts, and even set up recurring expenses.

With this information readily available, you can make informed decisions about where to cut costs and where to invest more.

Financial Reporting and Analysis:

Understanding your business’s financial health is crucial for making informed decisions. QuickBooks provides a wide range of financial reports, such as profit and loss statements, balance sheets, and cash flow statements.

These reports offer insights into your business’s performance, helping you identify trends, areas for improvement, and opportunities for growth.

Payroll Management:

Managing payroll can be a complex task, especially with changing tax regulations and employee benefits. QuickBooks offers a comprehensive payroll management system that allows you to calculate employee salaries, taxes, and deductions accurately.

It can also handle payroll tax filings and provide year-end tax forms for your employees.

Integration and Scalability:

QuickBooks is a flexible platform that can adapt to the changing needs of your business. It offers integration with a wide range of third-party apps and services, such as e-commerce platforms and customer relationship management (CRM) software.

Also Read: WHAT IS TURBOTAX

This makes it easy to customize QuickBooks to fit your specific requirements as your business grows.

Accessibility and Collaboration:

In today’s fast-paced business environment, accessibility and collaboration are crucial. QuickBooks provides cloud-based solutions that enable you to access your financial data from anywhere with an internet connection. It also allows multiple users to collaborate on financial tasks simultaneously, making it easier for your team to work together efficiently.

Tax Compliance Made Easy:

Small businesses often struggle with tax compliance, as tax laws and regulations can be complex and subject to change. QuickBooks simplifies this process by automatically tracking and categorizing transactions, making it easier to calculate your tax liabilities.

Also Read: DEMYSTIFYING THE F5 CERTIFICATION EXAM:

It can generate accurate reports for income tax, sales tax, and other taxes, ensuring that you meet your obligations without the stress of manual calculations and record-keeping errors.

Additionally, QuickBooks can help with year-end tax preparation by providing essential documents and financial data to your accountant.

Inventory Management and Cost Control:

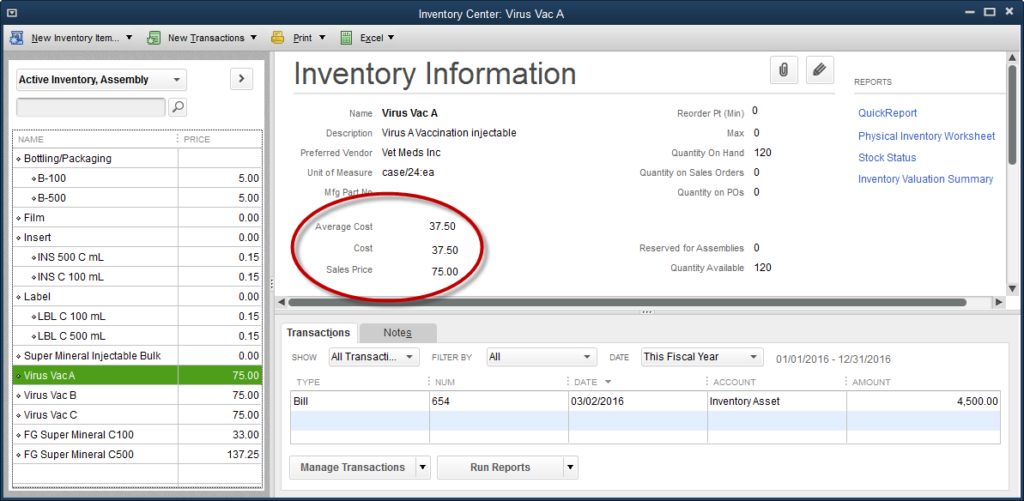

For businesses that sell physical products, managing inventory and controlling costs are critical. QuickBooks offers inventory tracking features that allow you to monitor stock levels, track the cost of goods sold, and even set up reorder points to avoid stockouts.

This helps you optimize inventory levels, reduce carrying costs, and improve cash flow. QuickBooks also integrates with e-commerce platforms and point-of-sale systems, streamlining the process of tracking sales and inventory in real-time.

Budgeting and Financial Planning:

Effective budgeting and financial planning are essential for the long-term success of any business. QuickBooks provides tools to create budgets and forecasts, helping you set financial goals and monitor your progress.

Also Read: 6 BEST INSTAGRAM GROWTH HACKS FOR BEGINNERS

By comparing actual financial data with your budgeted figures, you can identify variances and make adjustments as needed to stay on track. This proactive approach to financial planning enables small businesses to make informed decisions and allocate resources efficiently.

Customer Relationship Management (CRM) Integration:

Building and maintaining strong customer relationships is vital for small businesses. QuickBooks offers integration with CRM software, allowing you to centralize customer information, track interactions, and manage leads and sales opportunities.

This seamless integration enables you to provide better customer service, target marketing efforts more effectively, and ultimately increase sales and revenue. By having a 360-degree view of your customer relationships within QuickBooks, you can foster loyalty and growth.

Data Security and Backup Solutions:

Data security is a top priority for small businesses, especially when it comes to financial information. QuickBooks takes data security seriously by offering robust security features such as user access controls, encryption, and multi-factor authentication.

It also provides automated backup options, ensuring that your financial data is protected from loss or disaster. With QuickBooks, you can have peace of mind knowing that your sensitive financial information is secure and backed up regularly, reducing the risk of data breaches or data loss.

Time and Resource Savings:

Running a small business requires juggling various tasks and responsibilities. QuickBooks is designed to save you time and resources by automating many financial processes.

Also Read: CHARGOMEZ1

With features like bank reconciliation, automatic expense tracking, and recurring invoicing, you can significantly reduce the time spent on routine financial tasks.

This efficiency allows you to focus more on growing your business, serving customers, and pursuing strategic initiatives. QuickBooks effectively becomes a time-saving assistant that handles the financial details, so you can concentrate on what matters most to your business’s success.

Conclusion:

QuickBooks has become an invaluable tool for small businesses, simplifying financial management and allowing owners to focus on what they do best – growing their businesses.

With its user-friendly interface, automation capabilities, and robust features, QuickBooks has made financial tasks more efficient, accurate, and accessible.

Whether you’re a startup or an established small business, QuickBooks can help you take control of your finances and pave the way for success.

You May Also Like

wSerial – Understanding wSerial In 2023

October 13, 2023

From Punk Rock to the Catwalk: Demonia Shoe Styles

December 14, 2023